Cepi preliminary statistics for 2025 show European paper and board production decreased by 1.5%. The drop is similarly experienced by most global competitors. In Europe, the industry has capitalised on its leading position in bio-based and circular materials creating resilience.

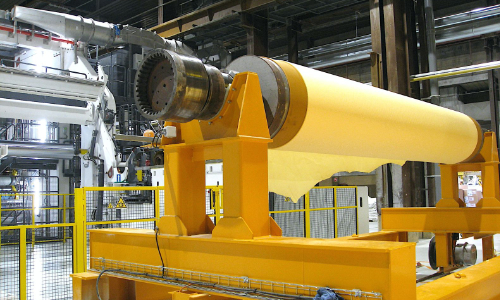

The production decreased by 1.5% compared to the previous year. The general trend since 2021 remains negative, reflecting the troubles encountered across all European manufacturing sectors over the past 5-year period due to adverse macro-economic trends: a sluggish demand, the heavy impact on the industry of high energy and manufacturing costs compared to global competitors, as well as growing regulatory burden in Europe, geopolitical challenges and rising trade tensions.

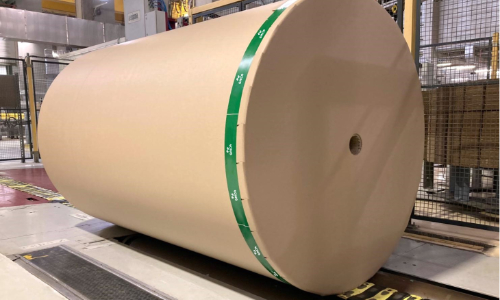

Graphic paper production, still more fragile than other segments, decreased by 7.2% in 2025. Focusing only on packaging paper and board (+0,1%), tissue paper (-0.8%) and other paper and board (+0.4%), European production looked relatively stable in 2025, but still 5.0% below the record level registered in 2021.

The performance of the European pulp and paper sector in 2025 is to be put in contrast with that of global competitors, and while global paper and board production remained unchanged (-0.3%). Production decreased more than in Europe in most paper and board producing countries in 2025. The United States, Japan, Canada and South Korea recorded a decline of their production (-1.9% to -5.7%). Exceptions are Brazil (+0.1%), an important pulp exporter to Europe, and China (+2.9%), which has accelerated paper and board production since 2020.

The trade balance of paper and board, although slightly eroding, decreased by 4.4% for the Cepi area compared to 2024 but remains largely positive, a unique position amongst energy-intensive sectors in Europe. Estimated on the most recent Eurostat data (11 months), EU paper and board exports have declined by 2.2% while imports are estimated to have increased by 1.4% in 2025, showing the fragility of the EU’s global competitive position.

Recent figures published by Deloitte show however that Europe is unmatched in crucial competitiveness metrics: biomass flows directed to biomaterials and circular material use rate, which is mainly driven by the EU’s paper and board sector.

Download the Cepi Preliminary Statistics Report 2025.

“Insufficient demand remains an important limiting factor to production. A further growth potential exists in replacing fossil-based materials but there we face an unlevel playing field with fossil-based materials and asymmetric information guiding the customer choices.”

“Bio-based circular materials offer advantages where it comes to supply chain resilience and European competitiveness. They are reflected in the most recent Cepi statistics and other studies published at the moment, including Deloitte’s Antwerp Declaration Monitoring Report.” Jori Ringman, Cepi Director General