The Administrative Court in Stockholm has granted Holmen the right to tax deductions linked to the Group’s previous operations in Spain. The decision will have a positive impact on the Group’s profit after tax of approximately SEK 400 million in the third quarter.

Holmen has claimed group deductions for tax losses in the Group’s Spanish subsidiaries after operations in the country were discontinued. The Swedish Tax Agency has denied the right to deductions. Holmen has appealed the Swedish Tax Agency’s decision and the Administrative Court in Stockholm has now found that Holmen is entitled to the deduction. The judgment will become final in two months unless it is appealed before then.

Photo/Holmen

RELATED NEWS

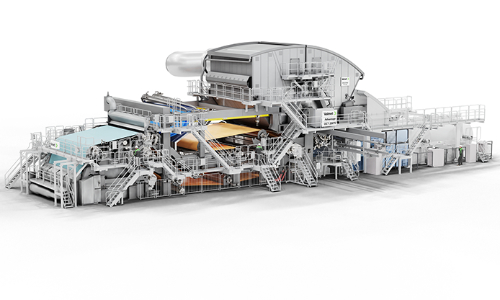

Sappi – Barrier papers move into the flexible packaging market

January 22, 2026

The WEPA Group intends to acquire a majority stake in MPH1865

January 22, 2026

Sonoco Chief Operating Officer Rodger Fuller to Retire

January 21, 2026

ABB achieves CDP A rankings for water and climate

January 15, 2026

Change in SCA’s Group Management

January 15, 2026

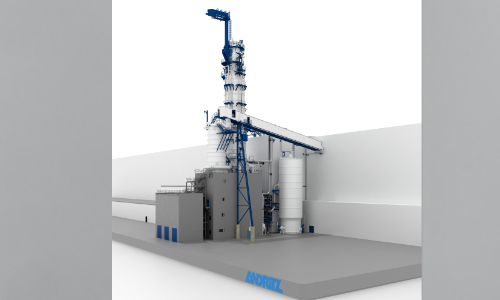

MM Group orders continuous cooking plant from Andritz

January 15, 2026

UPM receives leadership scores in CDP 2025 assessment

January 14, 2026

Mondi recognised with nine WorldStar Awards for packaging innovation

January 14, 2026

SEEPEX introduces its new generation of macerators

January 12, 2026