Stora Enso has completed the divestment, announced in May, of approximately 175,000 hectares of forest land, equivalent to 12.4% of its total forest land holdings in Sweden, for an enterprise value of SEK 9.8 billion, equivalent to EUR 900 million.

The buyers are Soya Group (40.6% ownership), and a MEAG-led consortium (44.4%). MEAG is the asset manager of Munich Re, a German insurance company. Stora Enso will retain a 15% ownership in the company.

Following the divestment, Stora Enso retains over 1.2 million hectares of forest land in Sweden, with a fair value of approximately EUR 5.6 billion as of 30 September 2025.

Photo/Stora Enso

RELATED NEWS

Best wishes for 2026 from the PaperFIRST Team

January 1, 2026

LATAMPAPER Buenos Aires – A must attend event in 2026

December 18, 2025

Elof Hansson appoints Lennart Eberleh as new CEO

December 17, 2025

Toscotec starts-up PM5 tissue line for Saudi Paper Group in Saudi Arabia

December 17, 2025

Rottneros President and CEO Lennart Eberleh has resigned

December 12, 2025

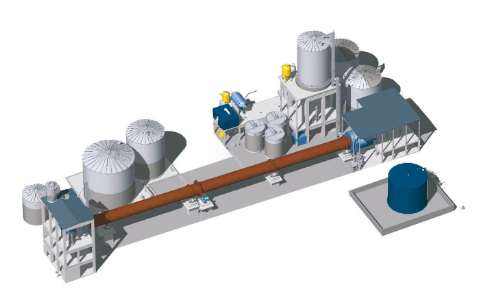

Andritz starts up sludge drying plant at Eldorado Brasil Celulose

December 12, 2025

GardaMatt Ice: Lecta’s new coated paper for premium publishing

December 12, 2025

SCA on CDP’s sustainability A-List 2025

December 10, 2025

Adestor Collect & Recycle teams up with SOPREMA to promote recycling

December 9, 2025

Billerud invests in the next level of fluting performance at Gruvön

December 9, 2025