Svenska Cellulosa Aktiebolaget SCA (publ) on May 8, 2018 established a Medium Term Note program (MTN) with a loan framework amounting to SEK 8 billion. Up to and including June 25, 2025 SCA has issued SEK 6.7 billion under the MTN program, of which SEK 4,5 billion is outstanding.

In relation to the MTN program, SCA on May 8, 2018 prepared and published a base prospectus, which will be updated annually. For this reason, SCA has updated the base prospectus which today, June 25, 2025, has been approved by the Swedish Financial Supervisory Authority (Finansinspektionen). The updated base prospectus will be available via the web sites of the Swedish Financial Supervisory Authority (www.fi.se) and SCA (www.sca.com). Hard copies may be obtained at SCAs head office in Sundsvall.

SCA has today also published an updated Green Bond Framework reflecting its sustainability strategy and integrating the most recent market practices and standards. SCA published its first Green Bond Framework in 2015 and has since issued Green Bonds totaling to SEK 3 billion as part of its sustainability strategy, which is deeply integrated into SCA’s overall business strategy.

S&P Global Ratings has reviewed the Green Bond Framework under its updated “Shades of Green” methodology and assessed its alignment with the ICMA (The International Capital Market Association) Green Bond Principles. SCA´s updated Green Bond Framework has received the highest “Dark Green” shading from S&P Global Ratings, in line with the framework established in 2021.

SCA has a unique position and abilities to contribute to a low carbon society. Overall, SCA’s forests and renewable products create a total climate benefit equivalent to approximately 12.5 million tonnes of CO2 per year, accounting for over 25% of Sweden’s total greenhouse gas emissions.

The updated framework covers Eligible Green Projects and Assets from following categories:

- Valuable forests

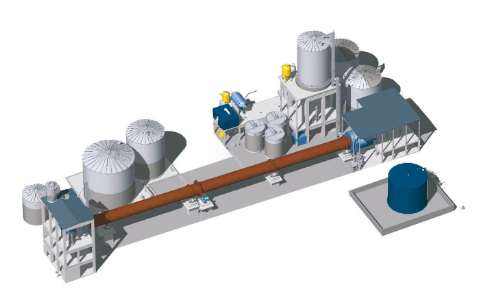

- Fossil-free world

- Efficient use of resources

By issuing green bonds under this framework, SCA aspires to continue the dialogue with investors and other stakeholders about sustainability commitments and progress in a transparent and consistent manner.

SEB acted as sole adviser on the structuring of the updated framework.

Full details on SCA’s Green Bond Framework and the Second Party Opinion can be found on our webpage.