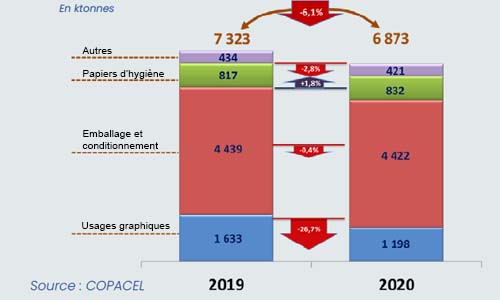

In a press conference held on 31 March, Copacel (French Union of Paperboard, Paper and Cellulose Industries) indicated that in 2020, the French paper industry saw its apparent consumption fall by 5.8% to 8 Mt. Production is also down by 6.1% to 6.9 Mt. Packaging papers held up very well (-0.4% vs. 2019), while the decline continued for graphic papers (-26.7%), mainly due to the shutdown of the UPM Chapelle Darblay mill. The tissue segment grew by 1,8 %, 832,000 t) following the start-up of a new tissue machine (Fregata Hygiène, Papeterie de la Montgolfière).

Last year, despite the constraints linked to the Covid-19, the vast majority of French paper companies did not interrupt their production, which enabled the manufacture of essential goods (food packaging, corrugated boxes for logistics, medicine boxes, hygiene papers, papers used by schools, etc.). However, despite this continued activity, the downturn in certain markets (newsprint, etc.), production difficulties (reduction in the number of shifts) and the closure of a plant prior to its sale led to this decline in production volume (-6,1 % as already mentioned) and in value (-12.7%).

Costs of several categories of fibrous raw materials have been rising significantly for several months

While pulp wood, which responds to a logic of regional balance between supply and demand, has remained at stable or even decreasing price levels, other fibrous raw materials have recorded marked increases for several months.

Firstly, there has been a very significant increase in the price of paper and cardboard for recycling (up to 300% over ten months for some grades!), reflecting sustained demand in Europe from paper mills producing paper and board for packaging. Another raw material that has been in a bullish cycle for several months is cellulose pulp. Its prices are under pressure due to the strength of Chinese demand and the lack of new production capacity. These increases in the price of fibrous raw materials will most likely have an upward impact on the price of paper and board.

Despite questions about the kinetics of the economic recovery, several trends offer a favourable outlook for different paper and board families

In a few months’ time, the end of restrictions (reopening of all shops, return to greater mobility), and the desire of consumers to “turn the page”, should result in an increase in consumption for various product segments (consumption of hygiene articles AFH –”Away From Home” –, use of office papers linked to the greater return of employees to their place of work, increase in “print” advertising, etc.). However, according to Copacel, this acceleration in activity could be thwarted by the gradual end of public support schemes for the economy.

Apart from the “Covid-19 effect”, several major trends will continue to drive demand for paper products. The importance attached to health issues is thus favourable to the use of hygiene articles. E-commerce and drive-through are consumer practices that have picked up in recent months and will continue to do so in the years to come. The consumer taste for manufactured goods made from renewable and easily recyclable resources feeds a natural sympathy for fibrous products. Finally, regulatory developments across Europe to restrict the use of single-use plastic items are opening up new markets for cellulosic products. However, consumption of a fraction of graphic papers (mainly newsprint) will continue to shrink as digital technologies continue to develop, so that paper production will in all likelihood be characterised by a “K” curve.

Valérie Lechiffre